PAN (Permanent Account Number) is a unique identification number issued to all taxpayers and tax deducted at source (TDS) withholding agents throughout Nepal. The one time allotted PAN of a taxpayer or TDS withholding agent never changes. It also serves as an identity proof. PAN is mandatory for financial transactions such as receiving a taxable salary or professional fees, sale or purchase of assets above specified limits, buy mutual funds and more.

PAN, VAT Information

साउन २०७६ देखि सरकारले कुनै पनि काम सेवा गरी तलबभत्ता, ज्याला लिने सबै नागरिकहरुले व्यक्तिगत स्थायी लेखा नम्बर अनिवार्य लिनुपर्ने व्यवस्था गरेको छ। नयाँ व्यवस्थासँगै कुनै कम्पनीले एक हजार रुपैयाँ भन्दा माथिको ज्याला वा पारिश्रमिक भूक्तानी गर्दा प्यान नम्बर समावेश गरी बैंकमार्फत गर्नुपर्नेछ। Read All Here: Job News

Also Read: How To Check Lok Sewa Aayog Vacancy & Result

How To Apply PAN Card Online In Nepal | Online PAN Card Registration Steps:

- First Collect your PP / Passport Size Photo and Citizenship Scan Copy / Soft Copy on PC or Laptop or any desktop on Cyber.

- Then search for IRD GOV NP on Google or go to http://www.ird.gov.np/ This will take you to Inland Revenue Department Nepal’s official website.

- Tips: If you know / get the PAN number of your Office where you work, you can search the PAN information and visit the nearby TAX Department. For example, the office where I work is registered its PAN in Putalisadak, so it will be better if I visit Putalisadak TAX Office to get my PAN card. To search the PAN registered of your Office, please go to here as shown in the picture below:

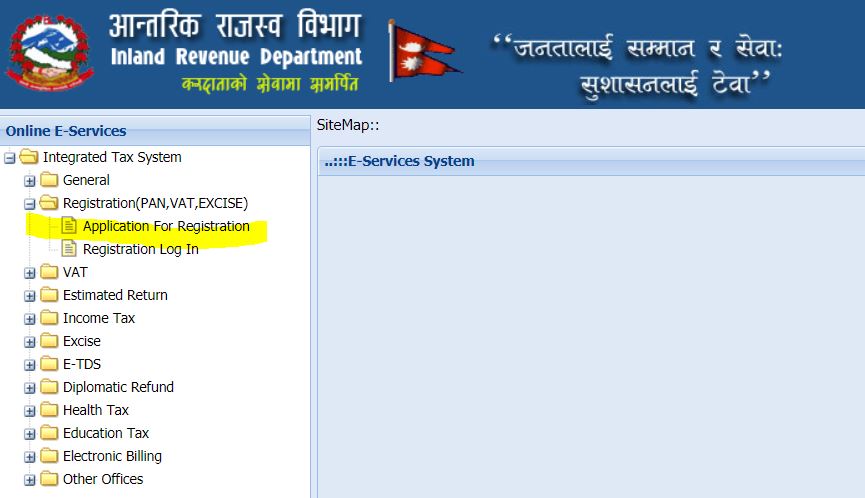

- Now, you have to sign up and get your Submission Number from this office. Scroll to bottom of this website. You will see “Taxpayer Portal”. Click it. You will see / redirect to another web page as shown in the picture below. From here you can sign up for PAN, or VAT or EXCISE. Also, you can login to your respected account(s). If its your first time, all you have to select is “Application For Registration”.

- After clicking on “Application For Registration”, you will see a sign up page. Here you need to create your new username, give password, email, personal contact number. For now, we are guiding you on PAN Registration. So, select as it is “Personal PAN”, “IRO/LTO” options and select IRO Name. For example: “आ. रा. का. पुतलीसडक”. Then click OK. Keep you login detail safe on Notepad. You will need this to login to your PAN Account on next time.

- After successful signup, you will get a unique SUBMISSION NUMBER. Keep it safe. You need this to login to your account. Click on ok or next and you will see a long form. You need to fill all your personal detail. You can see your citizenship and give credentials as mentioned on that. Simply, provide your exact personal detail (required both Devanagari and English Typing).

- During form fill up, you need to upload your passport sized photo and citizenship there. Please, fill exact private information and fill it carefully.

- If you made any mistake, you need to register again from the beginning that is from “Sign Up” process. It is because, once you submit / save the form, you cannot change your filled information. So, please be careful on that.

- Finally, click on Submit. Click on “Print”, convert to PDF and Print It Out. Also, Print out your Citizenship.

- Take both of your PAN Information Print and Citizenship Prints and go to the respected / recommended TAX Office / Department for eg: Putalisadak. Visit there, ask for the process, they will guide you to take your PAN. That’s all. You will get PAN Card within 5 to 10 Minutes. [Note: TAX Office Staffs’ Launch Time would be 1:30 to 2PM, so you can visit before 1PM or after 2PM]. If you have any confusion, you can comment and ask us below.